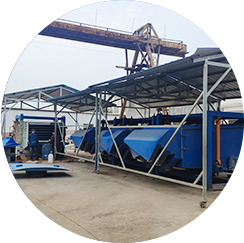

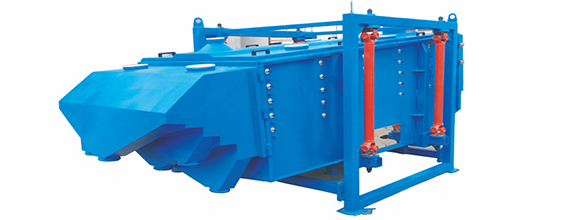

关于我们,betway备用网站 是国内专业生产方形振动筛、振动电机、震动电机的专业厂家。建厂至今,励精图治,开发并生产出了十五种产品一百多种规格,专业的摇摆筛厂家:产品已具成套化,从颗粒制粉、筛分、给料、输送、提升、搅拌、过滤、烘干、冷却等,是进行粉体加工到成品生产流水线作业的成套设备。

betway备用网站 地处巍巍太行山下,滔滔黄河岸边的豫北名城新乡市,京广、新荷铁路在此交汇,107国道贯穿南北。交通便利,地理位置优越,优良的设备,雄厚的技术力量,完善的检测手段,良好的企业信誉,得到了国内外广大新老客户的广泛赞誉。自动化的生产形式的驱动下,biwei必威备用网址 设备有限公司械形成了从提升输送设备、混合搅拌设备、振动筛分设备及产品包装设备的完整产品链,并可以为广大用户提供成套生产线设备的设计和制造。生产基地设立在河南。

公司主营:必威体育手机端下载 ,方形振动筛,摇摆筛厂家。

2023-09

2023-07

2023-07